We all have our dreams, wants, goals. We want a brand-new phone, car or travel to some remote destination. Today’s society compulsively buys and is being under influence of numerous advertising campaigns. Thus, spending sums of money is much easier than saving and restricting ourselves from buying an abundance of things we do not necessarily need. To be financially conscious is of utmost importance in order to use our money how we want and not how society determines.

SPENDING HABITS

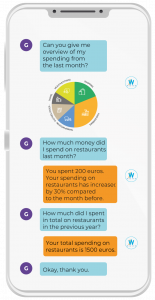

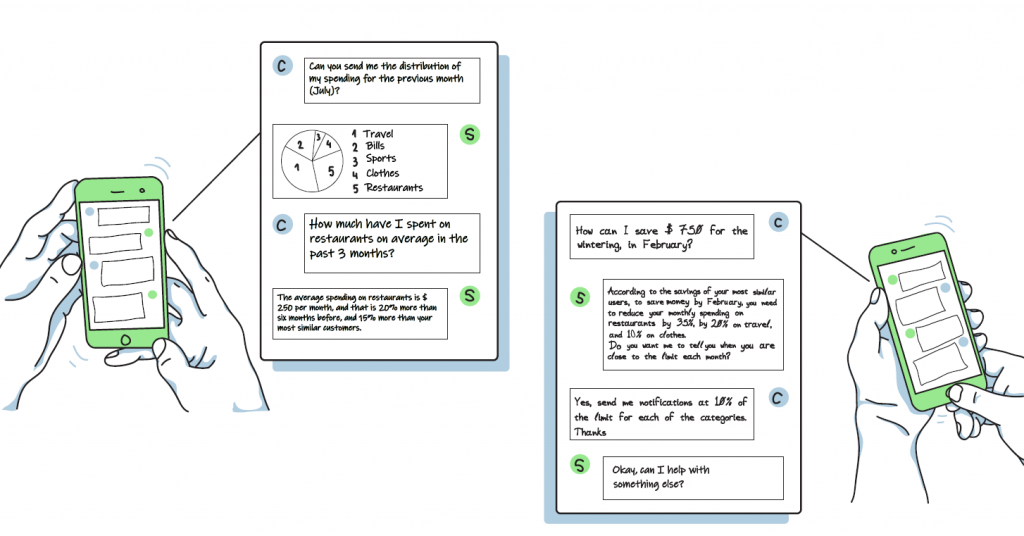

Firstly, what can help us to be aware of our spending habits is following flows of our spending – money allocation. Banks can leverage advanced analytics and provide their customers with spending statistics. Therefore, banking service is enhanced with additional value that provides to its customers. There are various approaches to transaction categorization, based on its resources each bank can find the most beneficial for itself. Banking sales or customer research experts can use spending insights about their customers and improve their approach and make data-informed decisions in day day-to-day business. On the other hand, each individual can forget about making manual records about each payment they made and fully enjoy the digital experience.

FRIENDLY REMINDERS

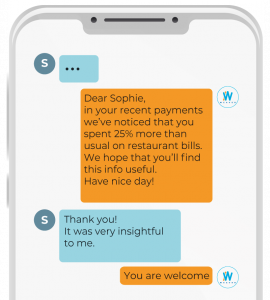

Not only does automatized transaction categorization benefit from showing historical records, but also, it can be used for further obtaining new insights about customer profiles and behavior patterns. For instance, if a customer has certain spending behavior, and starts spending more on a specific spending category – going out or clothing, he or she can be notified about this change. Again, this is one more way of providing customers with valuable information.

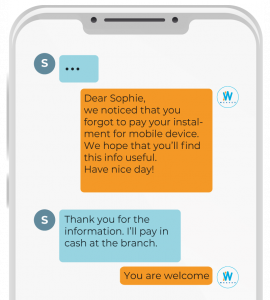

On the other hand, customers who are used to paying bills regularly at some specific time of the month. These recurring transactions can be caught and capitalized on. How could they be used? As reminders. If we took for example Sophie who pays her utilities in the last third of each month. If a few days after she usually covers them pass, she could be notified about that and offered with a possibility to pay them through some channel of the bank. In this way, that bank shows that cares for its customers and also boosts usage of its digital channels.

PERSONAL ADVISING

We get to the point where you understand your customer spending, track changes of it, and use all conclusions to upgrade your service and improve relations with all customers. If you are keen to make even one more step further and utilize spending comprehension for a bit more, this is the move. Advanced models can provide you with personalized saving plan recommendations for every individual based on his spending behavior and habits. In this way, why would a customer even think of changing your service? You provide financial awareness, friendly reminders, and individual saving plans. Your customers’ financial knowledge grows and enhances and you become a trusted financial partner.

TAKE WITH YOU

If there is something that you should take with you after this blog, that would be that customer data can enable you to gain more insights from customers’ data and provide an immense service upgrade. Following customers’ needs and behavior will guide you and help to level up your business and market position. Each piece of obtained information can lead you to new ideas and opportunities – where is demand and which parts of customer experience can be changed or improved.

Author:

Author:

Get to know

your customers

better.

FAQ | Finance | Banking | Telecommunications | Retail | Why Selecta | How it Works