Get banking ebook

Are you ready for

data driven banking?

Are you ready for

data driven banking?

Data-driven, high-quality experiences and insights to customers are the key for a bank to establish a relationship with customers and become their trusted advisor.

Financial relationship platform

based on artificial intelligence

Financial relationship platform

based on artificial intelligence

Data driven banking

Banks have a competitive advantage when it comes to data because of the quantity and quality of the data they hold. Information like customer’s spending habits, mediums of investment, response to marketing campaigns, etc. make banks the custodians of a wealth of data. An understanding of what data sources to use can drive improved approaches to decision-making. Traditional banks need to respond by effectively integrating all of their services to become a modern 360° financial partner for their customers. The bank’s ability to predict customer needs, offer personalized financial products and services, mitigate risks, and comply with ever-expanding regulations will be key to its success. This cohesive strategy implements modern data architecture, which integrates large volumes of data from many sources.

Data driven banking

Banks have a competitive advantage when it comes to data because of the quantity and quality of the data they hold. Information like customer’s spending habits, mediums of investment, response to marketing campaigns, etc. make banks the custodians of a wealth of data. An understanding of what data sources to use can drive improved approaches to decision-making. Traditional banks need to respond by effectively integrating all of their services to become a modern 360° financial partner for their customers. The bank’s ability to predict customer needs, offer personalized financial products and services, mitigate risks, and comply with ever-expanding regulations will be key to its success. This cohesive strategy implements modern data architecture, which integrates large volumes of data from many sources.

Major benefits

Better targeting

Process automation

Higher customer engagement

Personalized content and approach

Calculate next best offer

for your customer

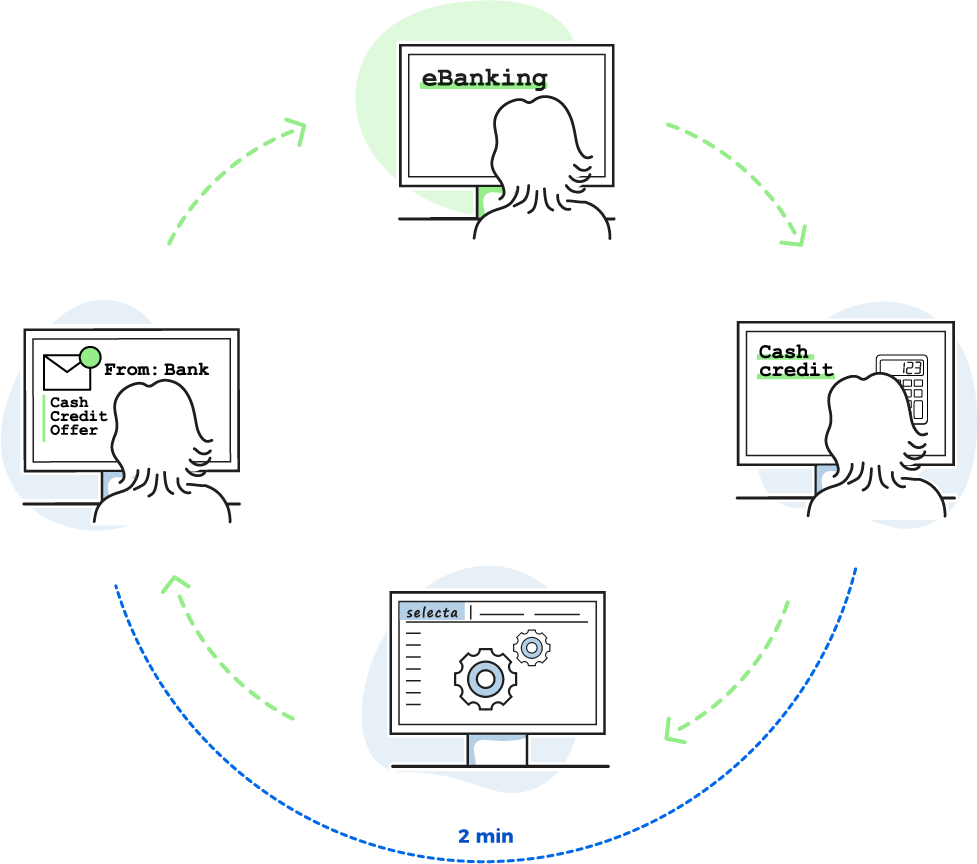

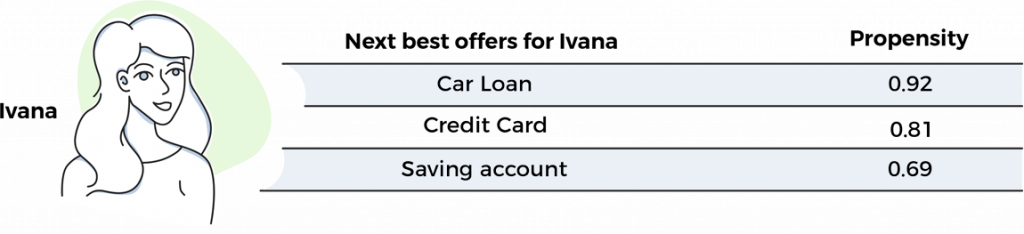

Next Best Offer model calculates customer tendency to make a purchase, or inclination to use a certain product or service that the client provides. The model uses available data gathered from various sources from previous months and makes predictions for the following time period. Let’s take a look on this example:

Customer used loan

calculator 3 times

Based on customer previous behavior toward the bank, the NBO calculates customer tendency to use the bank’s service/product

Loan offer sent to customer’s preferred channel

Firstly, bank’s customer used credit calculator for car loan more frequently in the previous month, compared to his behavior before the observing one. These activities have affected NBO model. Customer’s propensity for credit loan is increased compared to previous and this product become Next Best Offer for him. In the third step, based on this insight, the customer is offered with the credit loan over his preferred channel.

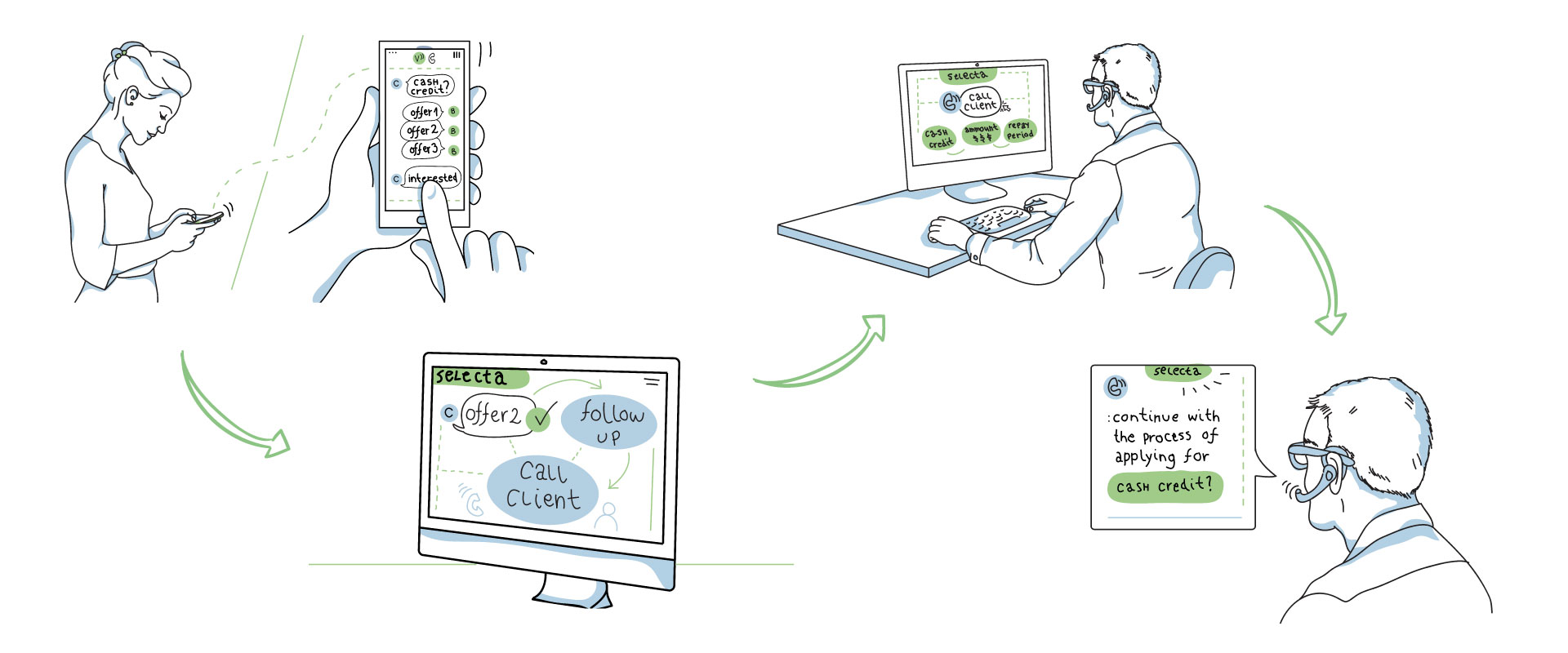

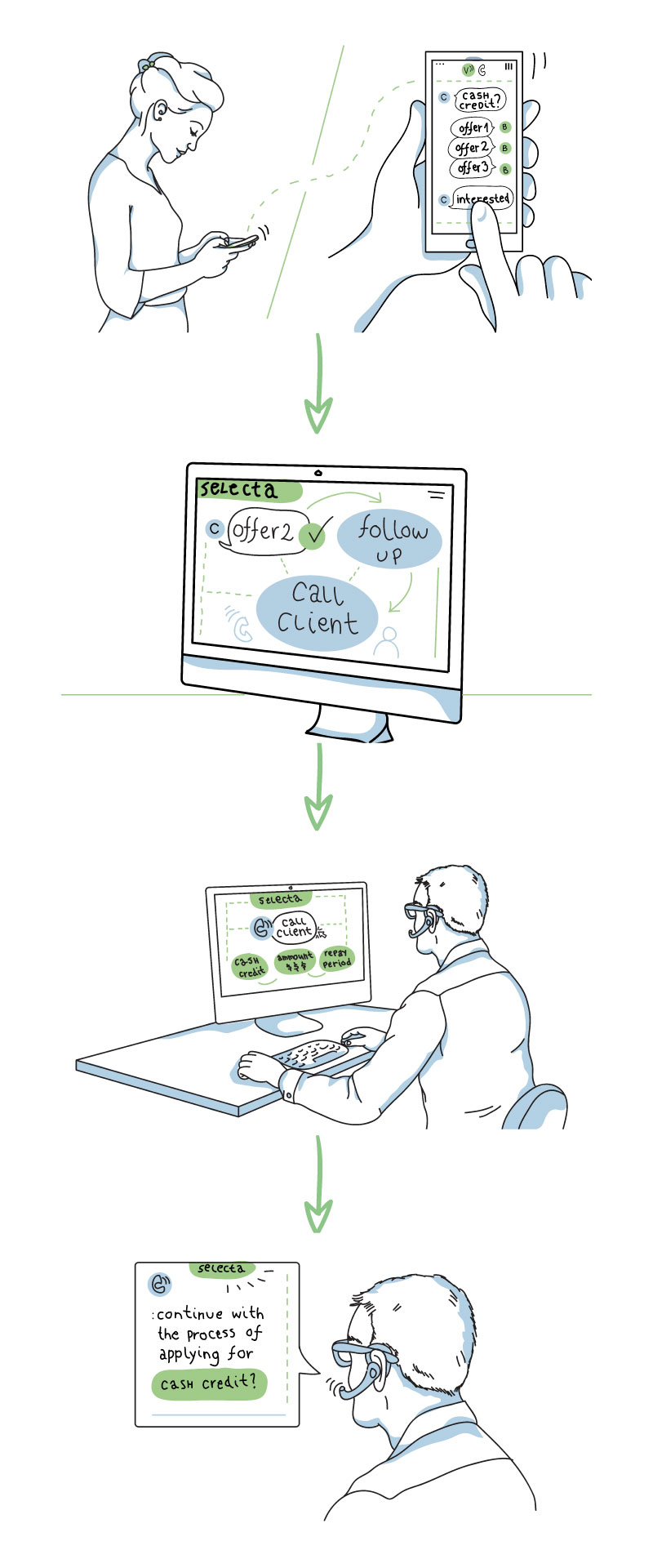

Automate your processes

Selecta enables sales and marketing automation, lead management, and the optimization of processes, while increasing customer engagement. The unified platform enables banks to provide omni-channel experience to their customers and empowers building long lasting relationships with customers.

Automate your processes

Selecta enables sales and marketing automation, lead management, and the optimization of processes, while increasing customer engagement. The unified platform enables banks to provide omni-channel experience to their customers and empowers building long lasting relationships with customers.

Understand customer’s behavior

The main aim of customer segmentation is to provide a better understanding of customer behavior, as well as to track the movement of the customers between segments. Segment characteristics are used for suggesting to the company how to approach specific customer profiles. Migrations between the segments enable tracking customer satisfaction and lifestyle changes.

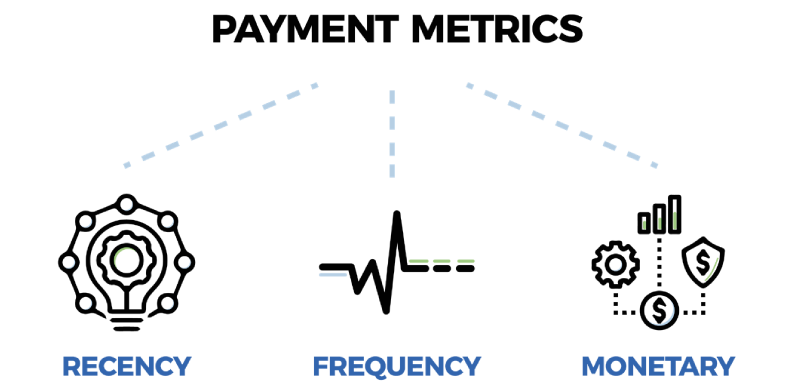

There are two types of segmentation, primary customer segmentation and advanced customer segmentation. Primary customer segmentation includes several models that are based on payment metrics – Recency, Frequency and Monetary. On the other hand, advanced segmentation combines customer spending and demographic characteristics (age, employment, number of children, marital status…) and generates appropriate customer segments and sub-segments. For instance, pre-adults, young adults with higher spending, middle-aged adults with lower spending, pensioners, and many more.

Make your clients stay with you

The churn model will recognize clients who intend to stop using a certain product or service. The goal of this model is early identification of customers who are likely to leave the company, so that the company can react and retain them. This information could be available through Selecta’s 360 customer profile or could be used for sending campaigns to the specific group of clients.

Data sources for this kind of model include transaction data, channel data (logging details, call center calls, etc), conversations with Chatbots, used products, blacklist data, complaints, internal classifications of the client, and others.

Decreased card activity, 2 new

complaints form same customer

Based on customer previous

behavior toward the bank,

the churn calculates customer

the tendency to use or purchase

a bank’s product or service

Tailor made offer to

the customer,

with better conditions

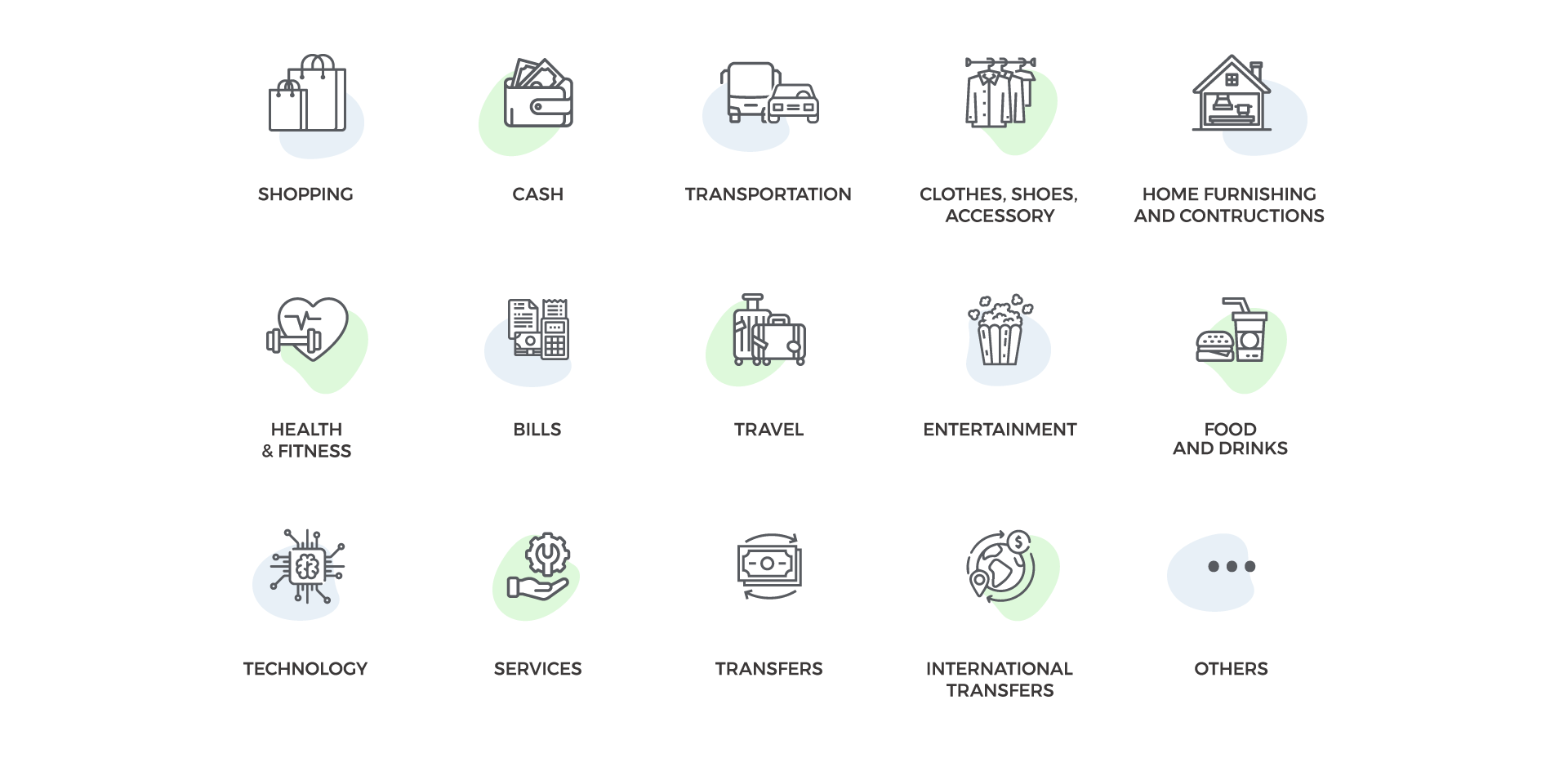

Use machine learning models for transaction categorization

Our AI algorithm enables banks to categorize correctly over 95% of customers’ transactions and embrace new, prosperous opportunities. Using a machine learning model for transaction categorization allows banks to track and monitor changes in customer spending. Moreover, obtained categories enrich customer profiling, point out their habits and enable personalized product offerings. Knowing customers’ preferences bank is enabled to personalize approach and create unique customer journeys.

The transaction categorization model helped in the development of several new spending machine learning models. These models are:

- spending tendency and prediction models,

- overspending tendency and prediction models,

- saving recommendation model.

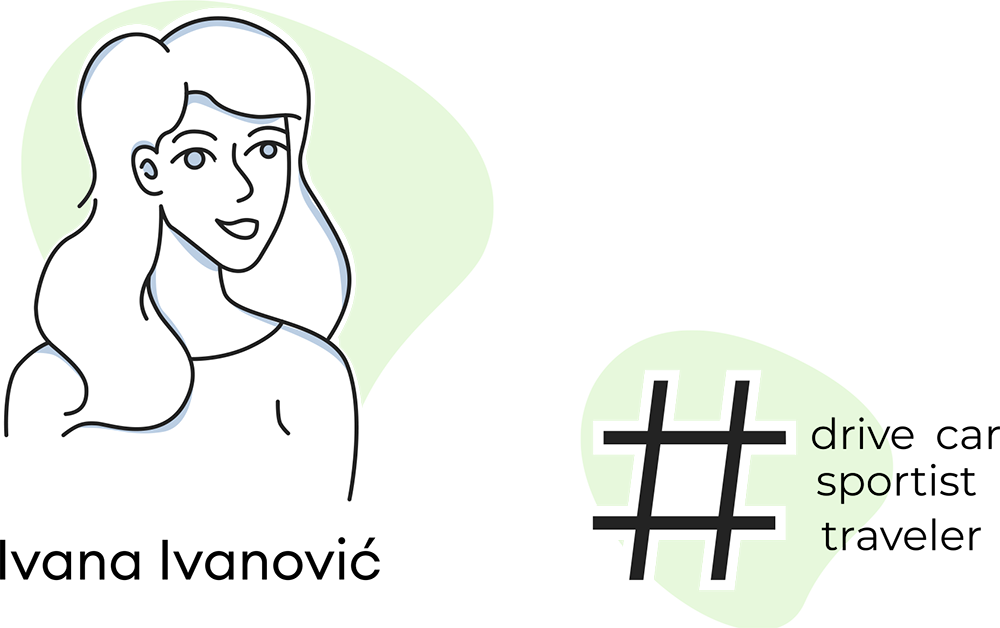

Customer spending behavior is described with hashtags (spending categories with the highest tendencies). For example, #traveler, #drive_car, #sportist, etc. Some of the major benefits for the Bank are shown in the next visual.

Every event related to customer is important for you

Each transaction, log on the banking applications, branch or website visit, conversations with the Chabot, all product-related events represent triggers for signaling in real-time. Signaling enables the Bank to create a highly personalized approach, conduct lightweight and precise targeting and to react on time.

Behind real-time monitoring of an immense number of events stands advanced Complex Event Processing Module. CPE Module allows the bank to track aggregated events, which are signaled when occur. Bank’s employees could set rules according to the bank’s needs. Rules could be set for transactions, customer segments and changes in spending on different categories.

What our clients

say about Selecta

“Customers are the most important intangible assets for many businesses across the globe. With the purpose to significantly improve the relationship with our customers and to strongly support the bank’s vision to be the most recommended financial institution in the Serbian market, Selecta supported by advanced analytics, has enabled us to build a robust sales/service platform with a unified and flexible interface to manage all customer touch-points for marketing and sales activities. With Selecta in place, we are maximizing Customer Lifetime value and consequently the bank’s Customer Equity”

Dragan Mikicic,

Head of CRM Department, Raiffeisen bank Serbia

What clients

say about Selecta

“Customers are the most important intangible assets for many businesses across the globe. With the purpose to significantly improve the relationship with our customers and to strongly support the bank’s vision to be the most recommended financial institution in the Serbian market, Selecta supported by advanced analytics, has enabled us to build a robust sales/service platform with a unified and flexible interface to manage all customer touch-points for marketing and sales activities. With Selecta in place, we are maximizing Customer Lifetime value and consequently the bank’s Customer Equity”

Dragan Mikicic,

Head of CRM Department, Raiffeisen bank Serbia

Pricing

Request product information, a demo of our

solution and price quotes.

Our representative is ready to answer your

questions and get a complete understanding

of your business needs, so you can receive a

price quote.

Our solution is completely modular. We work

alongside you to define what modules your

business needs!

Pricing

Request product information, a demo of our solution and price quotes.

Our representative is ready to answer your questions and get a complete understanding

of your business needs, so you can receive a price quote.

Our solution is completely modular. We work alongside you to define what modules your business needs!

Saga d.o.o. Belgrade

Member of New Frontier Group

64a Zorana Đinđića Blvd.

11070 Beograd | SERBIA

saga.rs

selecta@saga.rs